Published: Aug 10, 2024, 08:07 GMT+00:00

Key Points:

- US labor market data eased fears of a US economic recession driving BTC demand.

- Judge Analisa Torres delivered the final judgment in the SEC vs. Ripple case.

- The US courts ordered FTX and Alameda to pay $12.7 billion to its fraud victims.

In this article:

US Labor Market Data Reduces Fears of a Hard US Landing

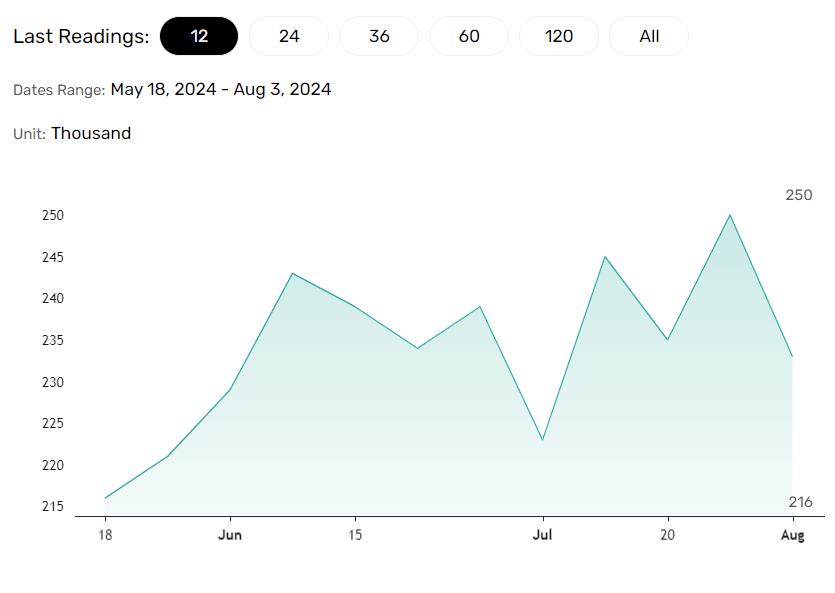

Recent US jobless claims data eased investor fears of a hard US landing. Initial jobless claims fell from 250k in the week ending July 27 to 233k in the week ending August 3. Tighter US labor market conditions could support wage growth, disposable income, and consumer spending. Private consumption contributes over 60% to the GDP.

BTC surged 12.0% on Thursday, as the numbers also reduced the threat of aggressive Fed rate cuts to bolster the US economy. Recession fears would overshadow the usual effects of Fed rate cuts on buyer demand for riskier assets.

US BTC-Spot ETF Market Records Weekly Outflows

In the week ending August 9, the US BTC-spot ETF market saw total net outflows of $167.0 million, following outflows of $80.7 million the previous week. According to Farside Investors:

- Grayscale Bitcoin Trust (GBTC) saw net outflows of $391.8 million in the week ending August 9 (previous week: -$245.1 million).

- Fidelity Wise Origin Bitcoin Fund (FBTC) had net outflows of $77.1 million (PW: -$192.9).

- ARK 21Shares Bitcoin ETF (ARKB) Bitwise Bitcoin ETF (BITB) reported net outflows of $65.1 million and $12.2 million, respectively.

- iShares Bitcoin Trust (IBIT) reported net inflows of $219.7 million.

- WisdomTree Bitcoin Fund (BTCW) had net inflows of $129.0 million.

- Grayscale Bitcoin Mini Trust (BTC) saw net inflows of $47.1 million.

US BTC-spot ETF market outflows partially offset BTC demand stemming from shifting sentiment toward the US labor market. However, oversupply risks lingered, with the Mt. Gox and the US government sitting on sizable BTC stockpiles.

BTC Oversupply Risk

Bitcoin (BTC) was up 3.81% to $60,524 from Monday, August 5 to Saturday, August 10. On Monday, BTC tumbled by 6.91% on expectations of narrowing interest rate differentials between the US and Japan. The USD/JPY fell to a Monday low of 141.684, on the Yen carry trade unwind. However, the US jobless claims data countered the effects of the US Jobs Report from Friday, August 2, Fed rate cut bets, supporting a BTC rebound.

Nevertheless, oversupply risks lingered, with Mt. Gox and the US government sitting on BTC stockpiles. On Saturday, August 10, the US government held 203,239 BTC ($12.28 billion), while Mt. Gox had 46,146 BTC ($2.79 billion) remaining to repay its creditors.

SEC vs. Ripple: Court Orders Ripple to Pay $125 Million

XRP was up 12.54% to $0.5889 from Monday, August 5, to Saturday, August 10. On Wednesday, August 7, Judge Analisa Torres delivered the final judgment in the SEC vs. Ripple case, ordering Ripple to pay a $125 million civil penalty. Judge Torres also granted the SEC’s request for an injunction prohibiting XRP sales to institutional investors. XRP rallied 18.30% to close the Wednesday session at $0.5999. However, XRP failed to target $1.00, with uncertainty about an SEC appeal against the Programmatic Sales of XRP ruling limiting the gains. In July 2023, XRP surged from sub-$0.50 to a high of $0.9327 in reaction to the Programmatic Sales of XRP ruling. However, XRP retreated to sub-$0.50 by mid-August on fears of an appeal. As background, Judge Analisa ruled that programmatic sales of XRP do not satisfy the third prong of the Howey Test. An end to SEC plans to appeal could drive XRP back toward $1.00.

FTX to Repay $12.7 Billion to Creditors

On Thursday, August 8, the US courts ordered FTX and Alameda to pay $12.7 billion to fraud victims.

The Commodity Futures Trading Commission announced the judgment, saying,

“The order requires FTX to pay $8.7 billion in restitution and $4 billion in disgorgement, which will be used to further compensate victims for losses suffered as a result of the massive fraudulent scheme orchestrated by Samuel Bankman-Fried, his now-bankrupt FTX group of companies, and a core group of FTX insiders.”

About the Author

With over 20 years of experience in the finance industry, Bob has been managing regional teams across Europe and Asia and focusing on analytics across both corporate and financial institutions. Currently he is covering developments relating to the financial markets, including currencies, commodities, alternative asset classes, and global equities.

Latest news and analysis

Advertisement