Highlights

- Service sector PMIs for November to give a litmus test of the global economy.

- Economic indicators from China and stimulus chatter could influence riskier assets.

- The US Jobs Report will wrap up the week and dictate the near-term US dollar trends.

The US Dollar

Factory orders kickstart the week for the US dollar. However, barring a slump in orders, investors may wait for more influential reports on Tuesday.

The all-important ISM Non-Manufacturing PMI and JOLTs Job Openings will be in focus on Tuesday. A pickup in service sector activity could test the theory of a less hawkish Fed rate path. However, labor market data could more significantly impact buyer demand for the US dollar.

A slide in job openings and a modest increase in ADP nonfarm payrolls (Wed) could show early signs of wear in the US labor market.

On Thursday, jobless claims, unit labor costs, and nonfarm productivity numbers also need consideration.

However, the US Jobs Report will be the focal point. Softer wage growth and looser labor market conditions could raise bets on an H1 2024 Fed rate cut. Deteriorating labor market conditions and a slump in consumer confidence would signal a sharp pullback in consumer spending. A pullback in spending would ease demand-driven inflation and affect the economy.

The EUR

On Monday, the German economy will be in the spotlight. Trade data for October will reveal any shift in global trade terms. A fall in exports would support expectations of a prolonged German recession and affect the appetite for the EUR/USD.

On Tuesday, service sector PMIs need investor consideration. The services sector contributes over 60% to the Eurozone economy. Weaker service sector activity would ease inflationary pressures and support a less hawkish ECB rate trajectory. The services sector is the main contributor to Eurozone inflation.

German factory orders and industrial production numbers will garner investor interest on Wednesday and Thursday. Better-than-expected numbers could raise hope of a mild recession. However, Eurozone GDP numbers also warrant investor attention on Thursday.

Finalized German inflation numbers wrap up the week. Revisions will influence expectations of an H1 2024 ECB rate cut.

Beyond the numbers, ECB commentary could also move the dial.

The Pound

UK retail sales and service sector PMI numbers will provide early direction to the Pound. While the retail sales numbers will influence the GBP/USD, revisions to the services PMI could have more impact. The UK services sector contributes over 70% to the UK economy.

On Thursday, US house prices also need consideration. A deterioration in housing sector conditions could impact consumer confidence and a signal weak consumption outlook.

Beyond the numbers, the Bank of England Financial Stability Report will draw investor interest on Wednesday. Bank of England Governor Bailey is also on the calendar to speak on Wednesday.

The Loonie

On Wednesday, the Bank of Canada will be in the spotlight. Recent speeches signaled an end to the rate hike cycle, leaving the Rate Statement to influence the Loonie. Ivey PMI, labor productivity, and trade data will likely play second fiddle to the BoC policy decision.

Bank of Canada Governor Tiff Macklem will wrap up the week, speaking on Thursday.

The Australian Dollar

On Monday, finalized retail sales, company gross operating profits, and home loans will impact the appetite for the Aussie dollar. A downward revision to retail sales and a larger-than-expected fall in company gross profits would weigh on the Aussie dollar. Sliding profits and a pullback in consumer spending would paint a gloomier picture of the Australian economy.

The RBA will be in the spotlight on Tuesday. Softer inflation numbers and a fall in consumer spending raised bets on the RBA hitting pause. However, the RBA Rate Statement needs consideration. Inflation remains elevated and could leave rate hikes on the table.

Q3 GDP numbers will move the dial on Wednesday before October trade figures on Thursday. A hotter-than-expected Australian economy and rising exports could refuel bets on an RBA move in the New Year.

The Kiwi Dollar

There are no economic indicators from New Zealand for investors to consider. The lack of stats will leave the Kiwi dollar in the hands of market risk sentiment and economic indicators from China.

The Japanese Yen

On Tuesday, inflation figures for Tokyo will influence the investor appetite for the Japanese Yen. Hotter-than-expected inflation numbers would pressure the Bank of Japan to exit negative rates.

However, service sector PMI numbers also need consideration on Tuesday. Weaker service sector activity could delay the timing of a BoJ pivot from ultra-loose monetary policy.

On Friday, household spending and Q3 GDP numbers will move the dial. A fall in household spending could add give the BoJ reason to delay a pivot from negative rates. However, Q3 GDP numbers on Friday will set the bar for the BoJ. The economy may need to improve before the BoJ is willing to exit negative rates.

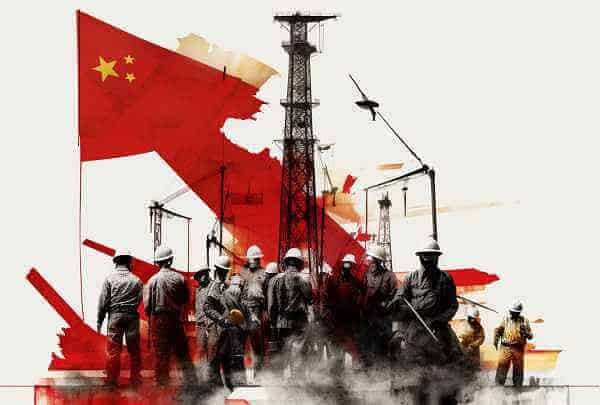

Out of China

Service sector PMI numbers on Tuesday will influence market risk sentiment. A pickup in service sector activity would provide more evidence of Beijing stimulus measures taking effect.

However, trade data could have more impact on Thursday. Weak exports would signal a weak global demand environment and may limit the effectiveness of stimulus measures.